(i) A partnership that has no income, deductions, or credits for federal income tax purposes for a taxable year is not required to file a partnership return for that year.

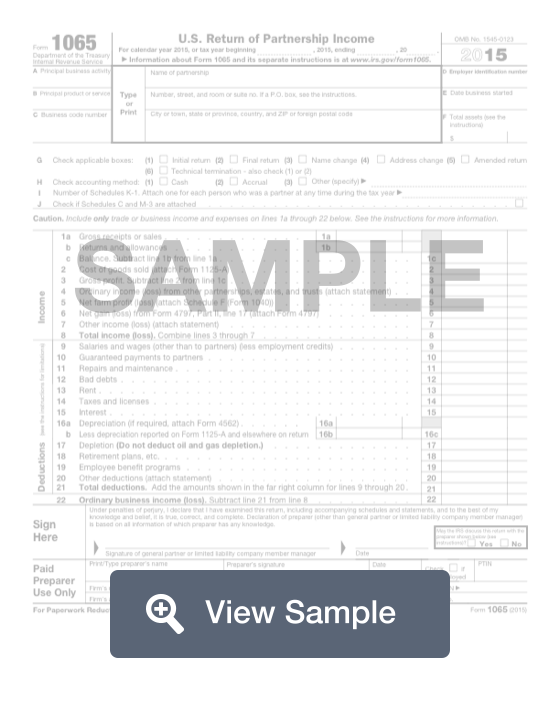

The partnership return must contain the information required by the prescribed form and the accompanying instructions. For the rules requiring the disclosure of certain transactions, see § 1.6011-4T. For the rules governing partnership statements to partners and nominees, see § 1.6031(b)-1T. For taxable years of a partnership and of a partner, see section 706 and § 1.706-1. The partnership return must be filed for the taxable year of the partnership regardless of the taxable years of the partners. Except as provided in paragraphs (a)(3) and (c) of this section, every domestic partnership must file a return of partnership income under section 6031 (partnership return) for each taxable year on the form prescribed for the partnership return.

§ 1.6031(a)-1 Return of partnership income.

0 kommentar(er)

0 kommentar(er)